Discover the Retirement Savings Strategy with Gold and Silver that Wowed Joe Montana.

Oh, and Your Host is the Director of Education at Augusta Precious Metals...

Don’t Miss Your Chance for Retirement Peace of Mind

Get the information and tools you need to be better educated about the economy and precious metals.

Sign up to see if you qualify for a free guide or one-on-one web meeting with Devlyn Steele.

A gold IRA can help diversify your retirement savings

Get Coached by a Winning Team

Free to attend—no cost or obligation. Only for those with

Augusta® is a Reliable, Accredited Business

What other retirement super savers are saying about Augusta Precious Metals...

When it Comes to Protecting Your Savings, Knowledge is Power

This web retirement conference helps consumers learn about (1) the gold IRA process and fees, (2) the economy, inflation, and reasons to buy gold, and (3) the industry and high-pressure techniques some other gold IRA companies use.

With the right knowledge backed by time-tested industry know-how, ordinary Americans could potentially protect their savings against a financial meltdown...

...with the potential opportunity for consistent capital growth too.

About Your Host - Devlyn Steele

Devlyn Steele, the Director of Education for Augusta Precious Metals, hosts your complimentary 1-on-1 web conference. Mr. Steele has spent more than thirty-five years as a financial analyst with broad industry experience.

As webinar leader, Devlyn simplifies complicated economic and financial concepts into practical, actionable strategies. His presentation explains Federal Reserve policies and their likely impact on future savings values.

Harvard trained and published author, Devlyn is currently Director of Education of Augusta Precious Metals.

What You'll Learn Can Save Time, Money and Stress!

Take control of you future - get coached by a winning team today - at zero cost or obligation.

Devlyn will show you one-on-one how precious metals outside or inside an IRA can help potentially offset losses during economic uncertainty and upheaval.

Augusta is devoted to creating an environment that makes it so easy for savers to learn more about gold and silver and the role it could play in sensible retirement planning…that they really have no reason not to.

Click the button below to

Award Winning Training

Unique in the metals industry

Industry Expert Panel

Leading experts here for you

Easy-Follow Videos

Even if you're just getting started

True 1-on-1 Interaction

Customized for your needs

Fully Online

Participate anywhere with Wi-Fi

Physical Investor Guide

+ free express shipping

Why Attend this Complimentary Gold IRA Retirement Conference?

A Gold IRA as part of sensible retirement planning could play a key role in helping you balance, diversify, and preserve your retirement savings' downside against de-dollarization, political divisions, and economic volatility - as long as it's handled correctly.

Individual Retirement Accounts (IRAs) account for more than one-third of Americans' retirement assets. Investors with plans for ten years have a mean average of $185,500 of value; those with plans for 20 years or longer have an average of $348,700, primarily invested in mutual funds or individual stocks.

With the Great Bull Market's end, the foundations of global economic growth and a secure retirement are under attack...

Since 2020, the world has experienced a global pandemic, inflation at a 40-year high, the Russian invasion of Ukraine, energy and food crises, and an attack on the American dollar as the world's reserve currency.

Global supply chains are in disarray, and countries are turning inward away from international trade. America's political future is uncertain.

Stock market values have fallen 20%, and many analysts predict a major recession in the next six to twelve months.

Retirement Planning Alert - The Bear is Coming

The financial news firm Bloomberg notes, "The Fed faces an almost impossible task of controlling inflation without seriously damaging the economy."

If you’re looking to add gold to an existing retirement account you'll need to use a gold IRA “rollover” or transfer.

The physical ownership of gold in an IRA provides critical portfolio diversification and a hedge against falling equity and bond values. Peter Lynch, the acclaimed Magellan Fund asset manager, advises investors to "know what you own and why you own it."

We agree wholeheartedly and as such are proud to introduce an interactive, 1-on-1 complimentary gold IRA web conference from Augusta Precious Metals for those investors with $100,000 or more in savings, a 401k, or IRA. Your customized 1-on-1 webinar covers gold's investment history, its value in an IRA, the mechanics of tax-advantaged retirement plans, and the nuances of balanced investing.

The Power of Knowledge

New financial products appear each week, their advocates claiming each to be the optimum investment for a secure retirement.

The list is overwhelming: common stocks, preferred stocks, Treasuries, call options, put options, commodities, corporate bonds, real estate investment trusts, digital currencies, precious metals, etc. Hundreds of financial TV shows, magazines, and newsletters compete with thousands of Certified Financial Planners (CFP®), Chartered Life Underwriters (CLU®), Registered Investment Advisers, registered representatives, and financial consultants.

Each claim to know the secrets of investing.

The challenge for investors is learning whom to trust.

What You Will Learn

No one cares as much about retirement as a retiree. We believe that knowledge about investing is crucial for everyone seeking to build and protect their savings. Augusta Precious Metals' webinar delivers critical information about diversifying, hedging, and protecting your savings for retirement, including the benefits of precious metals in an IRA, the logic of diversification, and the impact of economic events on investment values. The topics covered in the webinar include:

![]() Federal Reserve Actions and Investments

Federal Reserve Actions and Investments

The central bank of the US – aka the Federal Reserve – influences the economy and investments through its monetary and fiscal policies. The institution encourages growth by expanding the money supply and setting low-interest rates. Conversely, shrinking the money supply and raising interest rates dampens economic activity, sometimes resulting in a recession.

Due to higher inflation rates in 2022, the Fed has announced intentions to raise the Federal Funds interest rate considerably higher than the current 1.75%, translating to 5.5%-6.0% consumer rates. They also plan to lower the money supply significantly. During the past four decades, the Fed kept rates less than 2% and carelessly expanded the money supply. The conditions fueled the Great Bull Market (2009-2018). If history is a guide, values of equities and fixed income securities are likely to fall in the coming months.

Mr. Steele explains the decisions of the Fed in the webinar. With this information at their fingertips, attendees can collect and interpret the consequences of Fed moves before their impact.

![]() Gold as an Investment

Gold as an Investment

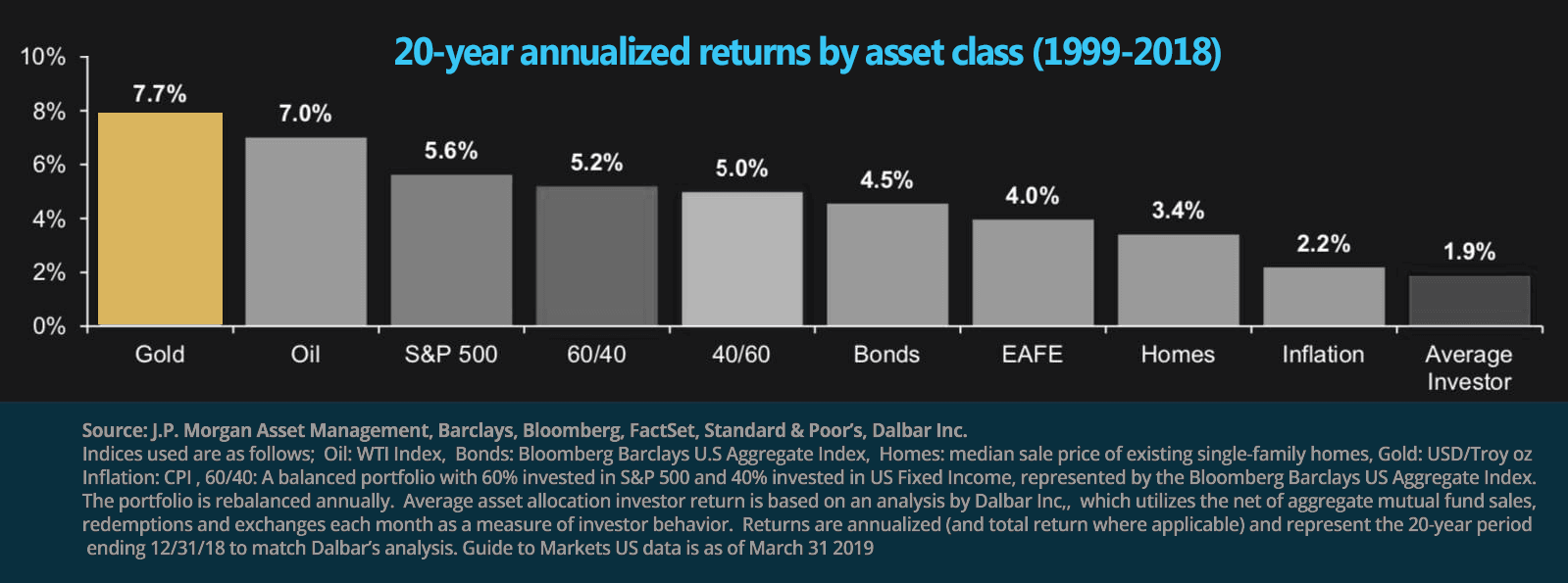

Many investors do not realize that precious metals have outperformed the S&P 500 and DJIA this century. Since 2000, though it's no guarantee of future performance, the investment return of gold has doubled the return of popular stock indexes.

Gold has been a favored investment in troubled times since the beginning of civilization. For most modern history, gold secured the acceptance of government-issued (fiat) money. Today, it is the "safe haven" of choice for investors seeking to avoid economic downturns and financial disasters.

![]() Gold to Hedge Market Risks

Gold to Hedge Market Risks

Diversification – the ownership of multiple assets simultaneously – is a fundamental strategy of asset managers and investors. Hedging complements diversification strategies. Farmers protect the value of their crops through commodity futures. Bookmakers secure their profit by having an equal amount of funds on both sides of a bet, i.e., a $100 to win, a $100 to lose. Equity portfolio managers secure the value of their funds by including a contra asset in the portfolio. For example, when asset A (the portfolio) falls in value, Asset B (the hedge) rises in value.

Gold is an attractive hedge against inflation, a depreciating dollar, or investment risk. In a broad sense, it is a hedge against a falling economy, lacking credit or default risks. Investors want a portfolio protector with a multi-millennium record. Research suggests that owning gold in an equity portfolio reduces volatility, a measure of risk. A review of the S&P 500 and gold during ten bear markets (1976 – 2020) shows the latter's superior returns.

While the 2022 bear market is likely to continue, early returns indicate that gold has again delivered a higher return. During your 1-on-1 retirement planning webinar, Mr. Steele covers gold's investment performance and factors to be considered when deciding to diversify your investment portfolio with gold.

Why Establish a Gold IRA?

Many IRA owners do not realize that owning gold in an IRA is legal and entitled to the same tax benefits as other regulated, tax-advantaged Traditional or Roth IRA accounts. The advantages include deducting the IRA contribution from taxable income (Traditional IRA accounts), tax-deferred growth during the investment period, and tax-free withdrawals (Roth IRA accounts). Unfortunately, purchases of physical gold are not allowed in existing IRA accounts unless established as a self-directed account, sometimes referred to as "Gold and Silver IRAs."

A gold IRA rollover is a tax-efficient way to add precious metals to your retirement portfolio. If you want to add gold to an existing retirement account, you'll need to use a gold IRA "rollover" or transfer.

There are required procedures to follow when using a rollover to move assets to a self-directed account, but they are neither burdensome nor expensive. Most sponsors help ensure the transfer is uneventful and retains its tax and investment advantages. Augusta Precious Metals' webinar provides detailed information about establishing, transferring assets, and managing Gold IRAs.

Final Thoughts

Many investors have never experienced an economy or investment period like today.

Inflation has been rising at its highest levels since the late 1970s; friend and foe alike challenge the American dollar's supremacy.

The US faces new economic and political opposition – the combination of China and Russia. Calls for Nationalism are rising globally, weakening supply chains shredded by the Covid pandemic. Efforts to reduce global warming conflict with national demands for adequate energy.

The time is especially perilous for those who saved and invested for their future. While there is no guaranteed strategy to preserve wealth, the odds indicate that history will repeat itself. Learning more about gold and its history as a store of value has never been more critical than today when it comes to sensible retirement planning.